The Massachusetts Gold Rush – Part 2

Does this ‘gold rush’ in the New World impact what we will see in the United Kingdom this year?

The Bureau of Ocean Energy Management (BOEM) in the US held the last offshore wind lease auction on 13-14 Dec for three sites adjacent to Vineyard Wind off the coast of Massachusetts. Those leases were won by Equinor, Mayflower Wind (a joint venture between Shell and EDPR) and Vineyard Wind (a joint venture between Avangrid and CIP) with total record prices of $405m. In our previous blog The Massachusetts Gold Rush – Part 1, we analysed the results of this auction, the reasons behind this bidding war and what it means for the US offshore wind market

With a new leasing round in the UK, The Crown Estate Round 4 (TCE R4), expected to launch in Q2 2019, a question comes to mind: will this Massachusetts Gold Rush have any influence in the TCE R4 winning bids? We think that the UK offshore wind market is the most attractive market in Europe and the competition on the lease rounds will certainly be fierce; in this article, we explore how fierce and why.

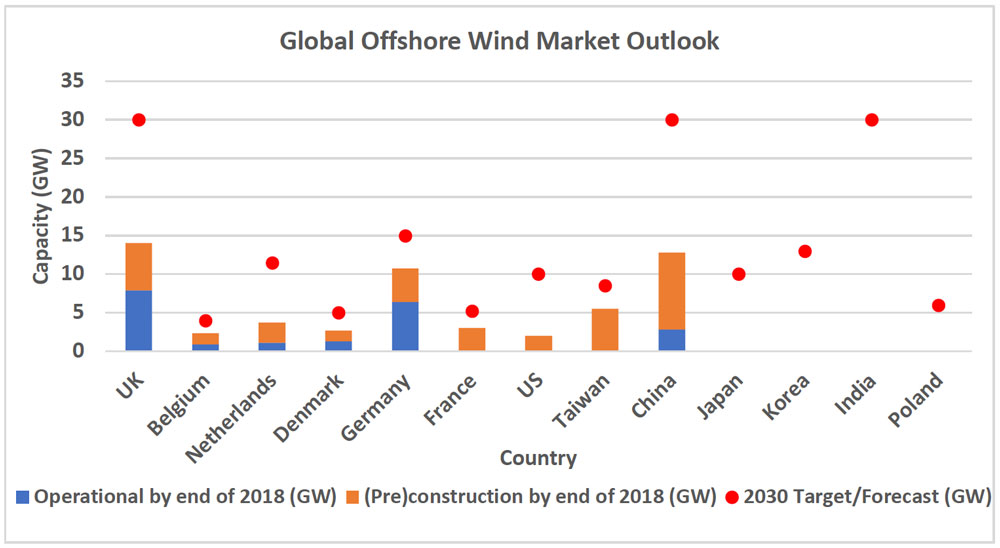

The UK is the world’s largest offshore wind market with 7.9 GW operational and 6.1 GW in different (pre)construction stages, i.e. with a route to market secured, as of the end of 2018. Apart from this, there are more than 16 GW of projects under development. All these developments are fuelled by the target of 30 GW by 2030 recently set by the industry and are on the verge of being adopted by the government in a sector deal soon to be announced. The government also provided some certainty with their bi-annual contract for difference (CfDs) auctions starting in Spring 2019; notwithstanding the lower than expected 2019 budget level.

Even if the 16 GW pipeline of projects is dominated by the main European utilities, there are still lots of international players new to the UK potentially interested in the market. These include EnBW, Northland Power, Enterprize (Yushan Energy), Parkwind, Shell and Eni. There is also a handful of existing players which could be interested in expanding their medium or small UK pipelines – Engie, Enbridge, Marubeni, Sumitomo, Macquarie and ESB. Of course, the biggest players in the UK market – Ørsted, Iberdrola/ScottishPower Renewables, Vattenfall, Innogy, Equinor, SSE, Red Rock Power, EDF and EDPR – could also be interested in adding sites close to their existing projects to benefit from synergies, or even just to diversify their portfolios with new areas. All of them attended the last engagement session held by TCE in November. There are plenty of miners for this Gold Rush at the other side of the Atlantic!

Furthermore, since the understanding and management of offshore wind risk is improving due to the ever-increasing experience, investors which traditionally only acquired stakes in projects in operation are progressively shifting to projects under construction to raise higher returns. At the same time, some players normally inclined to construction projects are also shifting their interest to pre-construction. Thus, this higher risk appetite and more competitive environment means that more players need to access projects earlier, even if it means taking on more development risk.

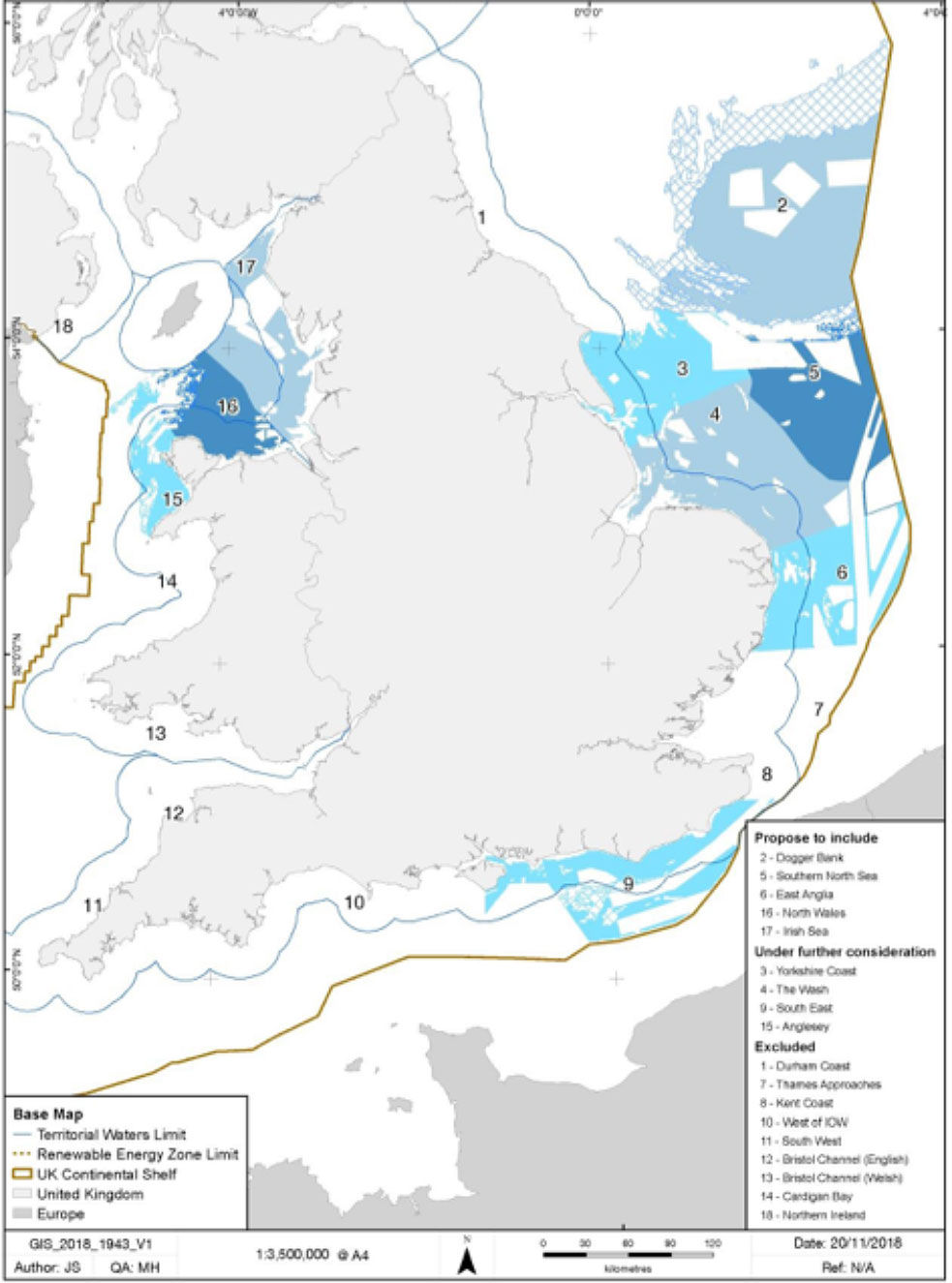

The TCE R4 lease process consists of a developer-led site selection process in predefined areas, presented in Figure 1. The developers have full flexibility in the selection of the site borders and capacities must be between 300 to 1500 MW, with the possibility of submitting multiple bids per area. There is a pre-qualification phase driven by financial strength and technical competence. The commercial assessment of bids is dependent on the option fee valuation in £/MW and, if there is a tie, in the option fee per km2. There is a total capacity cap in the lease process of 7 GW. A corporate group cannot be awarded an interest in projects totalling more than 3 GW and bidders can bid as a single legal entity or in a consortium, with the possibility of joining different consortia. Lastly, the bidding system in the UK is not electronic but multiple bids with applications, hence the bid prices won’t be as high as in Massachusetts.

Of course, the tender structure, the bidding system and the maturity and level of competition in the market are different in the UK from the auction held in Massachusetts, but there are some similarities – there are still golden nuggets in the UK!

Therefore, it is vital that developers understand the value of prospective project sites, whether their approach is a UK-wide analysis and filter approach or a more focused strategic review on specific areas driven by developer led criteria; you need to use the time available to infer the most about the project. But due to the commercial bidding element, you also need to understand how competitive your project area may be. There are a few ways we would suggest how to do this, but it starts with the best understanding of the project areas possible.

In our opinion, the UK currently is the most attractive offshore wind market in Europe due to the established and well-known regulations, the competitive and developed supply chain, the ambitious 30 GW by 2030 target and the government’s commitment to hold biannual CfD auctions.

The opportunity of building new projects comes from these capacity targets which, put in a global context, reveals the real magnitude of this endeavour. This can be appreciated in Figure 2, where we present our Global Offshore Wind Market Outlook. This shows the operational capacity by the end of 2018 and the capacity in pre-construction or construction stages (with government support secured). The UK 2030 targets are only matched by super energy-hungry India, which does have the ambition but does not have any capacity installed yet, 2030 forecasts for China, but with no history of foreign ownership despite having around 3 GW of offshore wind installed, and double Germany’s official target.

Even if the competition in the UK looks high, the TCE R4 is increasing the opportunity for newcomers breaking into this market – or at least providing a foothold in early phase projects – compared to other European markets. This can be justified by a brief comparison with the main European markets:

Netherlands has set an ultra-competitive environment with the first zero-subsidy project awarded in 2018 and the second zero-subsidy tender to be completed in 2019. They have a centralised system where the government auctions a pre-developed site and the grid connection at the same time. Their 2030 target is 11.5 GW from 3.7 GW auctioned today.

Germany has just transitioned from a de-centralised model (similar to the UK) to centralised tenders replicating the ones in the Netherlands. Their 2030 target is 15 GW from 10.7 GW auctioned today, but there is not a clear timeline of future auctions.

Denmark has a centralised tender model similar to the Netherlands, but the size of the market is small with 2.4 GW to be added by 2030 from 2.7 GW auctioned today.

Belgium has recently implemented a centralised model for future tenders similar to the Netherlands, but the size of the market is small with a 2030 target of 4 GW from 2.3 GW auctioned today.

France is the least developed European market among those mentioned, with no commercial projects operational today. This is due to the higher water depths in the majority of the French coast leading to the use of floating foundations, but also because of environmental and planning permission difficulties. Moreover, the French government recently announced their plans to increase offshore wind capacity just 2.2 GW from 3 GW in (pre)construction today. Finally, there is not a timeline for future tenders after the one in Dunkirk launched in 2018.

In conclusion, since the UK offshore wind market is the safest short-term and long-term bet in Europe, we expect that the competition for these leases will be as fierce as it was in the Massachusetts auction. Considering that developers and utilities now operate with project portfolios and pipelines in different phases of development, it could be strategic to secure rights for sites in the UK. This could suit developers willing to combine the exposure to new markets with mature and lower-risk markets, also allowing project portfolio, project development and procurement strategies, and taking into consideration the timeline for future CfD rounds.

The only concern we have is the risk that the TCE R4 adds new economical (relatively cheaper) sites into the UK pipeline that could compete for CfDs with more expensive 2nd/3rd phase R3 projects in the late 2020s. This could be another reason for developers with these large R3 zones to compete, a hedge for circa 2025-2030.

But don’t forget that there is still gold in the North!

In parallel to the TCE R4 lease process but slightly lagging, Crown Estate Scotland (CES) is expected to launch their own lease process for sites off the coast of Scotland and they have named it ScotWind. ScotWind is a less mature process compared to the TCE R4 and spatially and procedurally has not been completely defined, although there is a crucial difference in the commercial assessment of the bidders compared with the TCE R4 and Massachusetts auction. The evaluation criteria of ScotWind is the quantitative evaluation of the developers’ capabilities, experience and commitment to the project, as well as the project concept and delivery plan.

This might attract more developers to the Scottish tender as the outcome won’t depend on how deep your pockets are, but how good the team you assemble and the plan for your project are. However, these Scottish sites, which have not been specified yet, will probably be more challenging in regard to water depths, distance from shore and grid connection. So in one sense it is wise to keep the ‘cost of entry’ lower than the England and Wales process.

Contact Offshore Wind Consultants for more information, advice or to discuss how we could support your winning tender. Contact us if you need the best miners in your team for this Gold Rush!