New Request for Proposals for Offshore Wind Energy Generation in Massachusetts

On March 27th, Charlie Baker, Governor of Massachusetts, issued a Request for Proposals (RfP) for long term contracts for offshore wind energy generation and renewable energy certificates (RECs) [1]. This is the second offshore wind auction in Massachusetts after the first won by the joint venture Vineyard Wind (Avangrid and Copenhagen Infrastructure Partners) with an 800 MW project in May 2018.

The launch of this RfP also follows the momentum created after the record Bureau of Ocean Energy Management (BOEM) Outer Continental Shelf (OCS) lease auction held in Massachusetts on December 2018, which we carefully dissected in our post The Massachusetts Gold Rush Part 1. Equinor, the JV Mayflower Wind Energy (Shell and EDPR), and Vineyard Wind (Avangrid and CIP) each won an offshore wind energy lease with winning bids of $135m, $135m and $135.1m, respectively. This live auction lasted more than 32 rounds during two consecutive days and made the headlines all over the world, demonstrating the huge appetite for offshore wind leases in the US market and the definitive entrance of oil and gas majors in offshore wind.

The RfP at a glance

The proposal will be issued in May 2019, the submission on 9 August 2019 with winner selection in November 2019, leaving just enough time for the successful bidder to take advantage of the 12% Investment Tax Credit (ITC) expiring by the end of 2019. The RfP is very similar to the first one issued in 2017 and the latest commercial operations date (COD) of the prospective projects is the same; 1st January 2027.

The targeted capacity is 400 MW at least, but proposals from 200 MW to 800 MW will also be accepted if they provide more economic benefits for ratepayers. This will help Massachusetts to reach their offshore wind target of 1.6 GW of offshore wind generation feeding Massachusetts utilities by the end of June 2027. The Massachusetts utilities – Eversource, National Grid and Unitil – will evaluate the bids and negotiate the contracts with the winner, while the Baker administration oversees and formally launches the process.

Eligible bidders are those in possession of offshore wind development rights to offshore wind generation facilities and this includes all the winners of the previously noted late 2018 Massachusetts offshore wind energy lease auction.

Bidders can submit multiple responses including proposals with the co-location of energy storage system as an option so the project with and without storage would constitute separate bids. This was considered in the previous solicitation too. The potential addition of storage leads to a more complex evaluation of the bids as that could increase the bid price of the project but be recognised as providing additional benefits for ratepayers with regards to grid reliability, operation and stability. A deeper analysis of the implications and opportunities of storage is presented in the following sections.

RfP Bid evaluation and selection criteria

The bid evaluation and selection process will be conducted in three stages: it commences with the review of the projects to assess whether they meet the eligibility criteria, continues with the quantitative and qualitative evaluation of the bids and finishes with a further examination of the remaining bids and selection of the winning project. The bid evaluation criteria are complex, and quantitative and qualitative factors are analysed; giving 75 points to quantitative and 25 to qualitative factors, respectively.

In simple terms, the main quantitative factors are the comparison of the bid prices with the market price at the point of connection with the project in-service, the influence of the offshore wind generation in the price of RECs and the benefits of energy storage with regards to both criteria. In addition, per the bill “An Act to Promote Energy Diversity” signed by Gov. Baker in August 2016, the bid price has to be below the winning bid of the first Massachusetts solicitation. This requirement for lower price is tied to the consideration of benefit to ratepayers. The bid of that 800 MW project developed by Vineyard Wind has a levelised price of $65/MWh in 2017 prices [2].

On the other hand, the qualitative evaluation considers economic benefits such as employment creation, workforce development or investments in infrastructure and supply chain. It also considers the siting, permitting, project schedule and financing plan, and the mitigation and minimisation of environmental impacts.

If the bid includes a hybrid project there is a larger space for innovation, but achieving equilibrium with reliability, risk and net benefits for ratepayers is crucial. The benefits of the energy storage system could be accounted from a quantitative or qualitative viewpoint considering system reliability, stability and operational benefits such as: peak load shaving, reduction of curtailment of the offshore wind generation, provision of flexibility and ancillary services as frequency response, reserve and system balancing, and changes in capacity and ancillary services market prices, among others.

Strategic review of the bidders: who can bid?

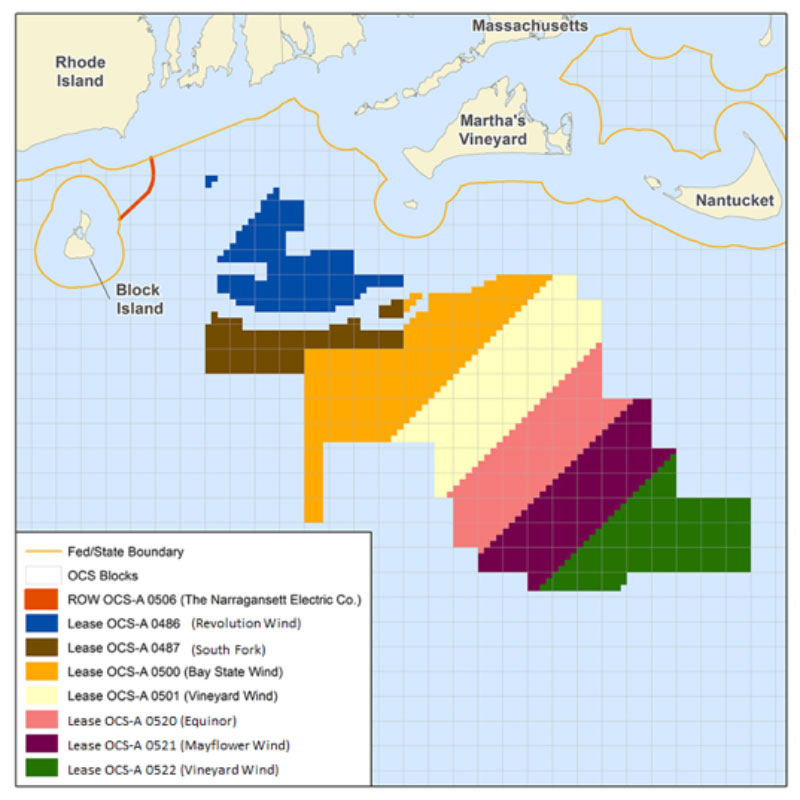

The potential bidders are developers in possession of offshore wind development rights. Considering that the electricity of the project has to be fed into ISO New England, the bidders could be the ones with leases in the vicinity of Massachusetts. Those sites are presented in the figure below.

Therefore, the potential bidders are:

Vineyard Wind: with 800 MW of offshore wind already awarded, more offshore wind capacity can be built in the OCS-A 0501 area. Vineyard Wind also acquired the site OCS-A 0522 in the last Massachusetts seabed lease auction and could bid with it.

Ørsted: the acquisition of Deepwater Wind last October brought around 0.9 GW of offshore wind capacity under contracts, spread in projects such as Revolution Wind, Block Island, South Fork and Skipjack. Ørsted could bid with Bay State Wind or Revolution Wind if more offshore wind capacity can be built in that latter area.

Equinor: own a lease in the New York Bight and could bid with their recently acquired project in the Massachusetts seabed lease auction.

Mayflower Wind Energy: the Shell and EDPR consortium could bid with their recently acquired project in the Massachusetts seabed lease auction.

Participation in the RfP by the sites recently acquired by Equinor, Mayflower Wind and Vineyard Wind is more challenging. Since the leases of their competitors were awarded long before, the developers have had additional time to undertake site characterisation surveys and stakeholder engagements leading to more refined project definitions and fewer uncertainties, although the latest COD by January 2027 gives them opportunities too. Prior to issuance of the solicitation, the timing and the timeframes for responsive bids were open for comments on the Department of Energy Resources (DOER) 83C II solicitation [3]. Vineyard Wind and Ørsted advocated for more compressed timeframes with submission deadlines in June to ease procurement and contracting activities securing the ITCs. Nevertheless, Mayflower Wind defended a submission date in August to conduct the necessary stakeholder engagements and data collection enhancing competition among bidders. In the end, DOER’s decision was aligned with Mayflower’s establishing 9th August as the submission deadline for the bids.

Strategic review of the bidders: what can they do to be more competitive?

As can be seen in the analysis of the RfP presented above, there are many opportunities to present cost reduction, cost optimisation and value creation drivers in the bids. OWC would like to briefly introduce a few of them:

- Economies of scale and synergies with existing projects for Vineyard Wind and Ørsted: they could exploit the proposed onshore and offshore infrastructure, site characterisation studies and surveys, logistics and O&M crews, vessels and bases.

- Offshore wind generation and storage co-optimisation: although adding an energy storage system is optional and the RfP is technology agnostic with regards to that system, if any, the selection of a battery could be the most feasible choice. The techno-economic optimisation of the hybrid system, the identification of the revenue stacking possibilities for the storage system, the forecasts on future technology costs and on the development of flexibility and ancillary services are all crucial. Furthermore, due to the characteristics of the energy storage system, its complete definition, design and installation could occur when the offshore wind farm design, procurement, construction and installation have already started. There is also a complex interplay between quantitative and qualitative benefits of including the energy storage system, as it could increase the bid price of the project but be recognised as more cost-efficient by the Massachusetts utilities. Although it should be noted that the project winning the first auction didn’t include the co-location of energy storage.

- Supply chain and economic benefits plans: selecting the commitments and investments on supply chain, infrastructure or workforce are essential. Achieving the right balance between local, national and global supply chains and investments will be complex, it can be expected that developers who have more advanced projects and so have a more mature supply chain engagement process, will have more information and data to hand in which to respond.

- Environmental and consenting plans and regulations: the mitigation and minimisation of environmental impacts are also considered among the qualitative criteria. The successful commercial development of an offshore wind energy project in the US would require site characterisation studies, metocean measurements and surveys, Site Assessment Plan (SAP), and Construction and Operations Plan (COP) to be submitted to BOEM.

- Transmission design: bidders will have to decide the transmission cable landfall location, onshore route and installation methods while minimising coastal and community impacts. The assessment of transmission and connection upgrades and the estimation of those costs will also be analysed under the scope of benefits to ratepayers. Solutions such as open access transmission systems, which are gaining momentum in the US due to the clustering of the sites in New England and New York Bight, could also be an option if they are widely embraced by the industry and regulators. Furthermore, developers will also need to consider other potential projects to be built in the area, share of infrastructure, project construction and installation.

Thus, Massachusetts utilities are looking for viable, cost-effective projects with limited risks and the competition is anticipated to be fierce. Developers should try to balance innovation, reliability and risk. They should provide a robust and credible project definition while keeping the maximum flexibility in the project design, plan and choice of technology.

Therefore, identifying the project’s assumptions and their variance, refining the technology development cost forecasts and identifying areas of potential cost savings are critical. These can be the differences between a profitable project, a project only feasible under an internal rate of return (IRR) below the company’s standards, or a decision to wait for next procurement rounds. OWC can deliver a third-party review of capex/opex models, technical studies, competitor analysis, technical or strategic advisory. OWC can also assist on procurement strategies, consent and environmental permitting, proposal preparation or supply chain planning. OWC also brings a long experience of the US offshore and Marine sector via it’s Houston based sister company Aqualis Offshore.

The clock is ticking, selecting which studies to undertake and which areas of cost reduction and value creation to focus before the August deadline are critical. Success will depend on accomplishing the right mix of local knowledge and international experience.

Contact Offshore Wind Consultants for more information, advice or to discuss how we could support your winning tender.

References

[1] “Long-Term Contracts for Offshore Wind Energy Generation Pursuant to Section 83C of Chapter 169 of the Acts of 2008,” [Online]. Available: https://macleanenergy.files.wordpress.com/2019/03/dpu-19-xxx-request-for-proposals-for-long-term-contracts-for-offshore-wind-energy-projects.pdf

[2] “Petitions for Approval of Proposed Long-Term Contracts for Offshore Wind Energy Pursuant to Section 83C of Chapter 188 of the Acts of 2016, DPU 18-76, 18-77, 18-78,” [Online]. Available: https://macleanenergy.files.wordpress.com/2018/08/doer-83c-filing-letter-dpu-18-76-18-77-18-78august-1-2018.pdf

[3] “Section 83c II,” [Online]. Available: https://macleanenergy.com/83c-ii/