Offshore Wind Market Study & Project Development

European Market Study | A collaborative study by OWC and China Energy Europe Renewable Energy Holding S.A.

Executive Summary

Europe’s offshore wind sector will continue to face headwinds in the short-term. Key issues such as supply chain constraints, lagging grid infrastructure development, high financing costs and permitting delays are unlikely to be resolved soon. A realignment of regulatory frameworks with investors’ risk appetite is also required in both mature and emerging markets. However, despite the challenges, new opportunities are on the horizon.

OWC and China Energy Europe Renewable Energy Holding S.A. are assessing European offshore wind market trends, opportunities, and some key issues to anticipate. Below, we summarise some key take-aways:

European offshore wind near-term market trends

Market Growth: Increased capacity targets and deployment

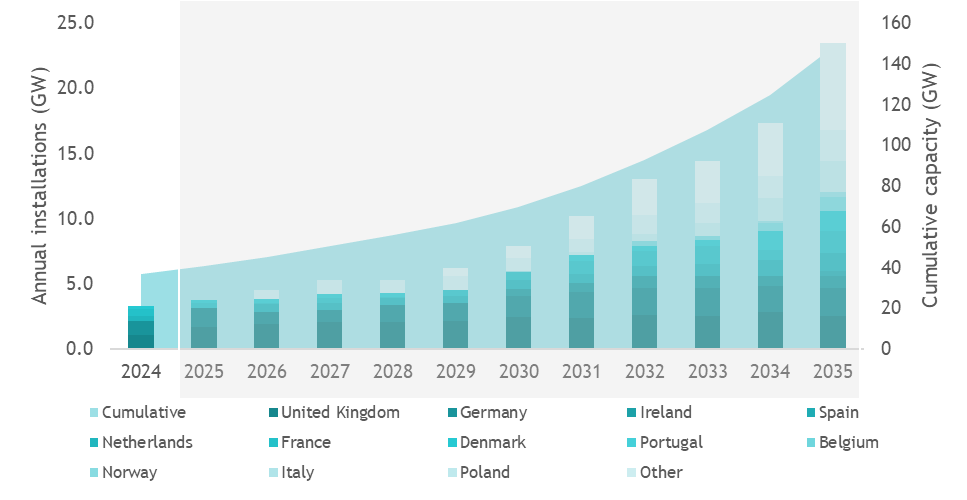

- The trend of increasing capacity targets and deployment in European offshore wind is underpinned by ambitious climate goals, geopolitical shifts, and technological advancements. The EU has set ambitious targets for offshore renewable energy (the majority being offshore wind), aiming for approximately 111 GW of installed capacity by 2030 and around 317 GW by 2050. OWC forecasts that Europe is on track to install almost 30 GWs of additional capacity between 2025 and 2030.

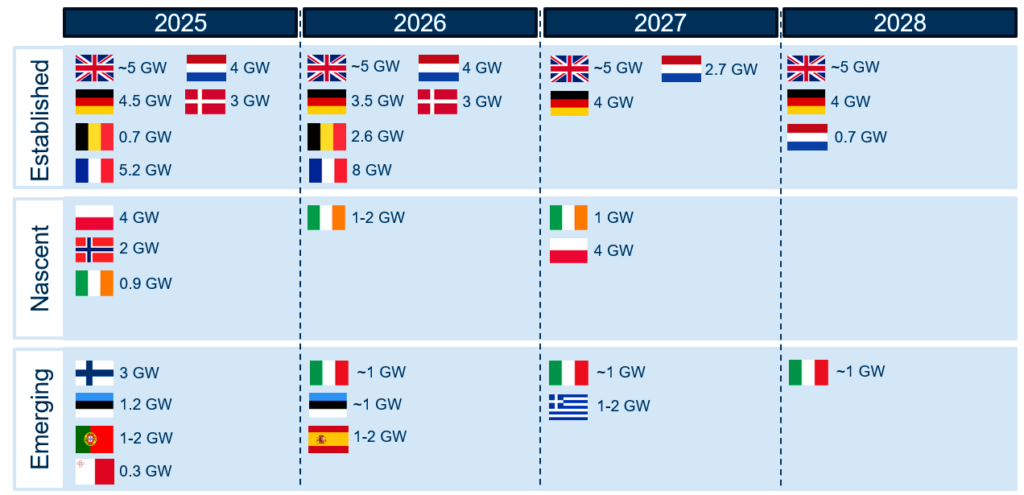

- Planned lease auctions in mature markets (Germany, UK, The Netherlands) and nascent and emerging offshore wind markets (France, Portugal, Spain, Poland, Italy, Romania) provide abundant opportunities to acquire seabed rights, but the cost of technology, revenue stabilisation, and competition will remain key issues in planned lease auctions.

Above: OWC Europe Offshore Wind Market Forecast (GW) . Source: (c) OWC: 2024

Auction design

- More conformity on CfD designs and improvements to reflect economic realities are required. A shift to two-way CfDs is anticipated. Market stability is increasingly being achieved with the increasing use of two-way CfDs, where developers receive top-up payments when market prices fall below a strike price and return surplus when prices exceed it. This form of mechanism ensures consumer protection from price volatility and offers necessary revenue stability to investors.

- Focus on cost of capital. With offshore wind having a high upfront capital expenditure (CapEx), reducing the cost of capital remains crucial. Governments are enhancing CfD designs to attract more participants by de-risking investments.

- Market variations. There have been modifications of the mechanisms in the UK and Germany, recent CfD rounds in these countries showed better alignment with market realities, with the UK’s AR6 clearing at £58.87/MWh.

Above: Upcoming offshore wind lease auctions (Europe). Source: (c) OWC: 2024

Technology and Markets: WTG super scaling

- Larger and more powerful WTGs – WTG sizes are scaling rapidly, with next-generation models exceeding 15 MW (e.g., SGRE received an EU grant for its next generation WTG – expected to be 21MW rating, platform upgrades could see upgrades pushing WTG to 17-18MW available prior to 2030, GE Vernova recently withdrew their 18MW platform resulting for a focus on the Haliade-X 15.5MW-250, but we would expect GE to revive the 18MW under market pressure). 20 MW+ turbines are expected by 2030, enabling fewer WTGs per project, reducing costs, and increasing output.

Scaling up deployment of floating wind

- Major floating wind inclusive leasing rounds such as ScotWind, INTOG and Celtic Sea projects are spearheading floating wind in Europe. The technology is critical for tapping into areas with deeper water but better wind conditions.

- Cost reduction – Standardisation of floating platforms and advancements in dynamic cabling are expected to reduce costs by the late 2020s.

- Projected growth – Though some of the excessive expectations have sensibly dampened from 2 years ago, floating wind could account for up to 20% of Europe’s offshore wind installations by 2035, supported by growing commercial interest and favourable policies.

Acceleration of grid modernisation and energy islands

- Energy Islands – Denmark’s energy island in the North Sea and Belgium’s modular offshore grid expansions exemplify the trend of grid modernisation, allowing multiple projects to share infrastructure.

- HVDC expansion – High Voltage Direct Current (HVDC) technology is becoming standard for connecting large offshore wind farms to distant grid hubs, though this is resulting in cable supply bottlenecks.

- Regional interconnectors: Collaborative projects like the North Sea Wind Power Hub are creating cross-border connections to improve grid reliability and balance renewable intermittency. ENTSO-e has also started to study potential interconnection options for all EU countries, which could allow the injection of additional offshore wind electricity.

Regulatory reforms and streamlining of permitting to accelerate deployment

- Faster permitting – The EU’s Renewable Energy Directive has set a two-year limit for permitting renewable energy projects in “go-to” areas. Several nations, including France and Germany, have implemented or proposed measures to fast-track Environmental Impact Assessments (EIA) and planning approvals

- One-Stop Shops – Countries like Denmark and France have introduced centralised “one-stop-shop” models, combining site, environmental, and construction permits into a streamlined process.

- Impact – These changes aim to reduce permitting delays caused by overlapping jurisdictional approvals, unlocking capacity needed to meet 2030 targets. In addition, such activities aim to reduce local opposition, which has historically impacted the development pace of various projects.

Key issues on the horizon

- Insufficient grid interconnection and infrastructure – There is a risk of delays or curtailments due to a lack of robust grid infrastructure to handle increasing energy inputs, particularly in countries with legacy grid systems. Cross-border interconnections and energy islands are being planned, but they remain underfunded or years away from completion as governance has yet to be specified.

- Supply chain bottlenecks – Rising demand for WTGs, subsea cables, and specialised vessels is creating severe delays in manufacturing and transportation, exacerbated by inflation and global material shortages. Many projects are competing for limited supply, increasing costs and extending lead times.

- Permitting delays – Despite recent efforts to streamline processes, permitting remains a bottleneck due to overlapping jurisdictions, prolonged Environmental Impact Assessments (EIAs), and local opposition. These delays often push projects beyond their planned timelines, increasing costs and investor uncertainty.

- Financing challenges due to high interest rates – Rising interest rates have increased the cost of capital, squeezed project margins and deterred investors from committing to long-term renewable energy projects. This has made CfD auction participation, where the interest rate and inflation rise were not accommodated in the offtake strike price, less attractive, with some rounds undersubscribed.

- Port and logistics constraints – Ports are struggling to accommodate larger WTGs, specialised vessels, and increased project traffic, creating delays in installation schedules. Many European ports require significant upgrades to meet the demands of the growing offshore wind industry, especially for the significant demand of floating wind.

- Wake Effect (‘Theft’) – The wake effect, where WTGs downstream suffer reduced energy production due to wind turbulence caused by upstream WTGs, is an ongoing and increasing challenge in densely packed wind farm zones. This reduces overall efficiency and can create disputes over site layouts and energy output forecasts.

Authors

Craig Brown

Principal Consultant – Head of Market Studies

OWC France

John MacAskill

Managing Director Renewables

ABL Group

Vasilis Markatselis

Dpt. Service Line Lead – Market Studies

OWC UK

Contact us to find out more about this study on European Offshore Wind, and to discuss how our market studies team can support you: