Maritime’s role on the road to Greece’s 2GW of Offshore Wind

Greece’s plans towards net-zero are gathering pace, and it’s the country’s high winds taking center stage in national plans to decarbonise. With 4GW of already installed onshore wind capacity, the government has set their sights on developing a utility-scale offshore wind market, recognising massive potential to be reaped from harnessing the abundant wind resource out at sea. Last year, the Prime Minister committed to 2GW of offshore wind to be fully commissioned by 2030. At least 1.5GW of the projected 2GW are expected to be floating wind, taking into consideration the country’s deep waters. And this is only the beginning, with projections of 30-40 GW of floating wind by 2050.

This is all good news and a positive boost for both European offshore and floating wind as well as local energy security. However, it is nonetheless a big leap to go from 0 offshore capacity to 2GW in 8 years’ time. With expectations Greece will want the local supply chain to dominate in the development process, the opportunity is huge for local renewable energy companies and the maritime sector alike. But with significant ground to be made in a relatively short time, with opportunity, comes challenge.

Here we explore some of the challenges ahead from a marine perspective, and how one of Greece’s largest industries – maritime – can support the country on its road to 2GW.

How to navigate Greece’s already busy waters?

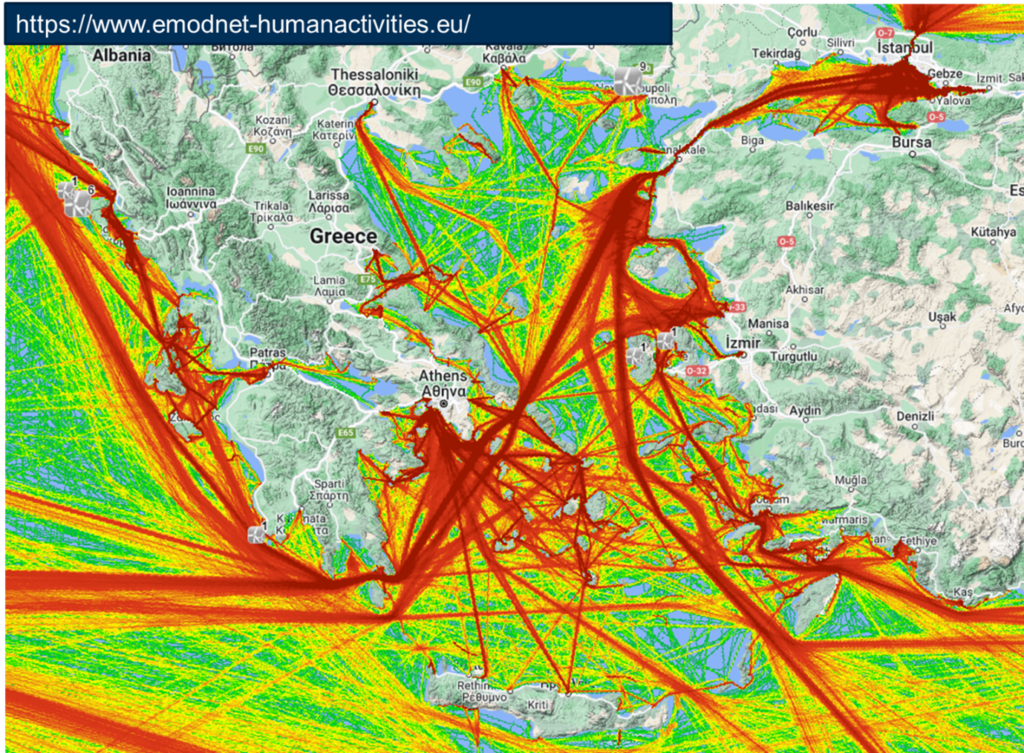

Greece is expected to face the challenge of fitting the new offshore wind developments into an already tight network of shipping routes, Natura 2000 – a network of nature protection areas across the EU, tourist attractions and fishing areas (just to name a few). The initial indication is that Greece will have to navigate this on an ad-hoc basis. Contrary to most coastal EU member States, Greece does not have a finalised Maritime Spatial Plan in place, that explicitly allocates space to offshore wind. This presents the challenge that relevant project proposals will have to be assessed and permitted individually and not as part of an overall integral plan if Greece is to achieve their 2 GW target by 2030.

The fact that Greece has not yet proclaimed an Exclusive Economic Zone (EEZ) poses a further challenge, as developments are likely to take place within the 6m zone of territorial waters, where there is substantial interaction with coastal cargo, fishing, and recreational vessel traffic. In the central Aegean Sea, the close-knit network of islands with pertinent interconnecting routes and high seasonality of passenger traffic, pose an additional challenge to integrating offshore wind developments, in an area where the water depths, wind speed and intensity profile would make ideal offshore wind sites.

To address the challenges of offshore wind development to fit in with navigational traffic, without compromising the safety of the new installations as well as that of the vessels navigating the space around them, authorities and developers should proceed to assessing the existing and post-development navigational risk in the areas of interest. The industry has a comprehensive toolkit to investigate these issues, to identify and quantify risks, and develop proposals for their mitigation that can be verified using the same methodologies. ABL itself, has a track record in offering relevant services in the Baltic Sea, North Sea, and Irish Sea.

Greece will need significant port facilities

Being the state with the third longest coastline in Europe, Greece has a large port industry, with more than 140 seaports, out of which 16 facilitate international trade. On the face of it, the country could be well positioned in terms of port availability to support an upcoming busy period of offshore wind construction as well as future O&M.

That said, most ports are focused on passenger and local supply transport, and thus lack the developed real estate to facilitate the construction and maintenance operations associated with the breakthrough to 2 GW within the next 2 years. Even the largest ports such as that of Alexandroupolis will face the challenge of integrating the demand from large scale offshore wind-related operations to their current trade volumes. Investment will have to be directed towards the upgrade and expansion of ports in Greece to accommodate the required operational capacity.

Also important is the interconnectivity of ports to the industrial centers within the mainland. Greece will likely push for maximum possible local content in the offshore wind development mix. This will most likely be through the manufacture of steelwork and the assembly and integration of other components. The expectation is that this will occur mainly in industrial areas around Athens, and in Thessaly. From there, the supply chain will have to find its way to project ports and the final installation locations.

Eventually, Greece will need to develop either through construction or upgrade, the necessary shoreside facilities for the assembly, operation and maintenance of the upcoming offshore wind projects. ABL maritime civil engineers have been providing consulting and engineering to ports in the UK, Ireland and USA, to support them in meeting requirements for floating offshore wind.

A Mecca of shipbuilding…Greece will need to tool up its fleet

Delivering the challenging target of 2GW of offshore wind power to be installed in less than 8 years, as declared by the Greek government, poses many currently unresolved issues surrounding the creation of sufficient assembly lines at ports that would allow for such a massive development.

On top of that, the lack of availability of the appropriate vessels for a future proof maintenance concept for the exchange of large wind turbine components offshore, is a concern that the market faces globally, and Greece will be no exception. The challenge to tow floating wind turbines to port, and the scarcity of the size of cranes required for such maintenance works is an issue that the industry will need to solve.

Both these aspects create a unique challenge and opportunity for Greece to invest in a market segment that will not only support their own local market but also – to the extent logistics will allow it – the anticipated market demand globally. ABL has the necessary experience to support such developments and the operation of such activities.

Conclusion

Greece is taking steps in the right direction towards reducing reliance on fossil fuels, but also in enhancing its energy security. The commitments so far are bold, but exciting in the opportunity they bring to the local market, as well as the signal they send to other countries looking to dip their toes in offshore wind. Without a doubt, the next 8 years will be paved with many challenges, but from a marine perspective, Greece has a strong maritime legacy and infrastructure, which can play a major role in helping overcome some of the key challenges in taking wind energy offshore. The government now needs to look at incentives and investment in gearing up their legacy infrastructure and their most traditionally renowned market, to suit the requirements of both fixed and floating offshore wind construction and operations and help the country on its road to net-zero.

Who knows….first step helping build Greece’s offshore wind industry…next step supporting the wider Mediterranean floating wind industry!

Vasilis Giotas

Country Manager OWC Greece

George Savvopoulos

Maritime Civil Engineering Consultant, ABL London