Insights from the Latest German Offshore Wind Auction: Challenges and Outcomes

The recent offshore wind auction in Germany for pre-investigated sites has shed light on both opportunities and significant challenges in the industry. One of our Senior Consultants, Kirsty Watt, has spotlighted this topic and summated her thoughts for us below.

Here’s a breakdown of the key takeaways:

Winners Announced:

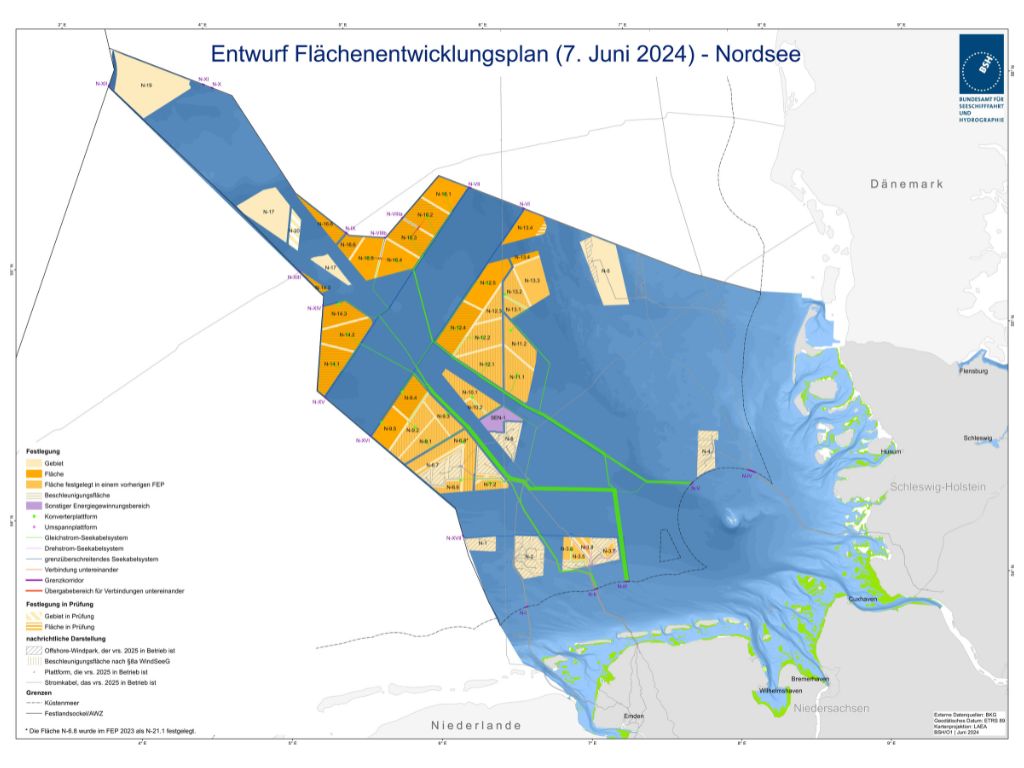

- RWE secured two major sites, N.9.1 and N.9.2, with a total capacity of 2 GW each. Located 115km off Borkum in the North Sea, these sites were won with a bid of €250 million. Potential partnership with Total Energies could be on the horizon, with commissioning expected in the early 2030s.

- Luxcara won site N-9.3 with the shortest project timeline, which has a capacity of 1.5 GW, through their entity Waterekke Energy GmbH. Will they select Mingyang Smart Energy as WTG supplier as they just did for Waterkant?

Low Bidder Turnout:

- Only 5 bids were placed for the 3 available sites—a clear sign of low interest. It could be argued that this was down to the sites low full load hour potential, eroding returns and prospects for PPAs thus deterring developers and investors.

Challenges in the Auction Process:

- Ambiguous Qualitative Criteria: The absence of clear guidelines introduced significant complexity for bid writers, hindering their ability to present a fully optimised case.

- Transparency Issues: Tender proceeds, which should reduce electricity costs and support marine conservation, aren’t being published by the Bundesnetzagentur, as the bid values could then be calculated. However this transparency is needed to understand the extent of support being injected into upgrades and conservation.

- Negative Bidding Concerns: The BWO has urged the German government to rethink the framework, as negative bidding drives up costs for the customer and strains the supply chain.

Beyond Grid Updates:

- The transformation of the German offshore wind sector must extend beyond grid upgrades. Upgrades are crucial for the entire supply chain, including German sea ports, to support future growth.

Lessons Learned:

- Developer Strategy: RWE’s low bid underscores the importance of participation—engage as the level of competition may be limited and could capitalise on low per MW charges. For example, RWE will be paying EUR 62,500 EUR for this auction in contrast to the non pre-investigated sites which went for EUR 1,305,000 per MW for N.11.2 and EUR 1,065,000 per MW for N-12.3.

- Market Attractiveness: The German offshore wind market presents mixed signals—low full load hours, reduced transparency, and supply chain challenges are hurdles, but the country’s mature experience in the North Sea, a clear timeline of auctions, high offshore wind targets, a large demand for cost-competitive clean electricity (unaided by the troubled onshore renewable development) could be an advantage.

OWC at WindEnergy Hamburg 2024:

Considering the challenges similar to those in other markets, is the German offshore wind market still attractive? It remains a question of strategy and timing for potential developers. The landscape is complex, but with Germany’s track record, there are opportunities for those ready to navigate the challenges.

We will be in attendance at WindEnergy Hamburg 2024 this September! You can catch our team in Hall B2, at Stand 422, to discuss your energy project. Alternatively, please reach out to our German Country Manager Nils Falkenhorst to discuss auction results and bid support for 2025. If you’d like to beat the crowds, you can book a meeting in advance of WindEnergy below!

When: 24 – 27 September 2024

Where: Hall B2, Stand 422, WindEnergy Hamburg, Germany