CfD 3 Analysis – OWC’s Deep Dive into the Future

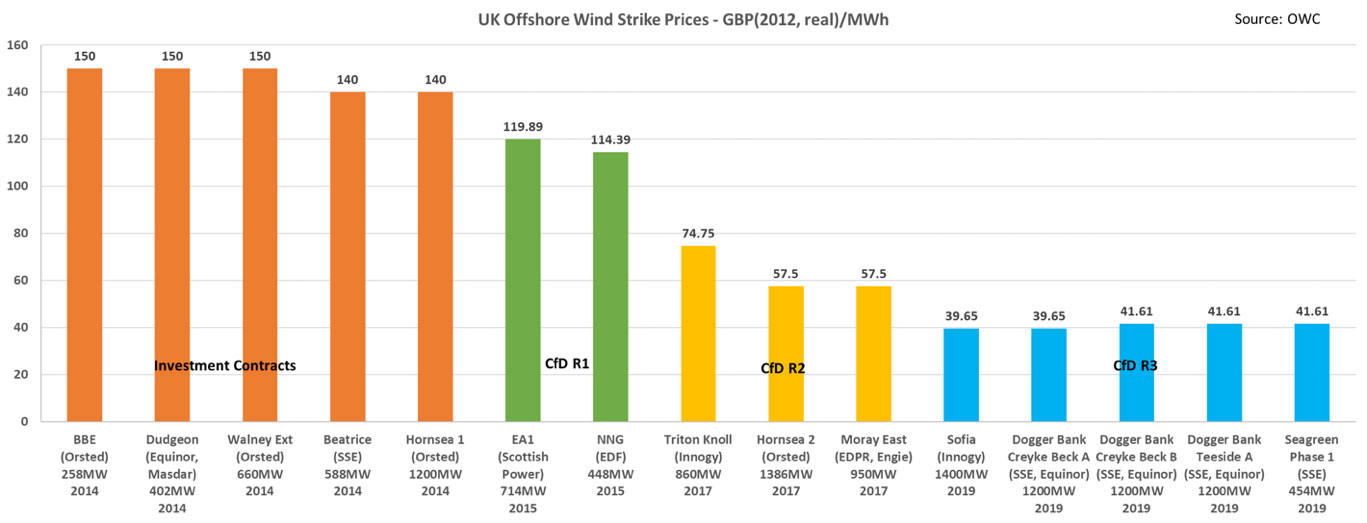

Friday’s CfD3 award announcement seemed a long time in coming, but that may be more to do with the rather chaotic times we are living in. In July 2011 – yes that long ago! – DECC published its UK Renewable Energy Road map with the ambition to “…drive down costs…to £100MWh by 2020”. The results of this auction compared with the latest CfD auctions are presented in the figure below and yes, this milestone was broken in CfD2 round by Triton Knoll and, spectacularly, by Hornsea 2 and Moray East with awards of £74.75/MWh and £57.50/MWh, in 2012 prices, respectively. But last week’s announcement with projects to be commissioned in 2023/24 and 2024/25 being awarded CfDs of £39.65/MWh and £41.61/MWh, in 2012 prices, respectively, reached a level of project economics that is a real game changer for the UK but also poses a few questions.

The results of this auction reveal three clear winners in SSE, Equinor and Innogy. SSE and Equinor, team up for three projects in Dogger Bank totalling 3.6GW, SSE also got 454MW in the Firth of Forth independently, and Innogy got Sofia in Dogger Bank with 1.4GW.

Pay money back to the treasury

These record low prices, which have caught all by surprise, will support the UK’s net zero by 2050 commitment, but only if they can be delivered adequately managing project risks and without compromising the supply chain, which is one the main pillars of the Offshore Wind Sector Deal.

Since the strike prices are below market prices, depending on price cannibalisation levels and commodity prices, they would all be paying back money to the treasury and so being virtually subsidy free. Developers are then paying a premium over market prices to stabilise their revenue over the duration of the CfD contract.

While these are all good news for developers and billpayers, there are a number of developing issues and challenges from Friday that will have to be addressed and worked through.

Delight and impending doom

The supply chain would have viewed Friday with a mixture of delight and possibly a bit of impending doom. Without a doubt, part of the developer’s CfD strategy will be to seek further savings from the supply chain. Whilst all tiers of a supply chain should contribute to driving inefficiencies out of a project, the industry has to guard against eating into reasonable profit margins, this is the road to lower quality and service, short cuts and a more contractually adversarial environment. Not many in the supply chain will speak out at this time, but Boskalis are big enough and when reporting their first half year results they suggested that ‘zero-subsidy’ projects had ratcheted-up “tension” in the sector amid a “drastically changed attitude” as developers looked to desperately trim costs [1].

The industry does have to drive down costs and continue to do so, and when we see contractors complaining about an overly contractual environment the words ‘pot’ and ‘black’ do come to mind, but developers will need to ensure they squeeze out non-value added activity in a supply chain’s value chain, not squeeze until there is no value left.

This directly leads onto another challenge for the UK industry.

Drive a stake through above 50% UK content?

Does this round of CfD awards drive a stake through above 50% UK content? Is the choice this stark? Does the UK want lower subsidy prices and therefore lower electricity bills or higher local content and higher prices delivering more UK jobs? Because it will be really challenging to achieve 60% of local content, the 2030 target mentioned in the sector deal, with such low prices. We already see substructure contracts placed in Spain, Dubai and likely soon the Far East in a drive for CAPEX savings. This will intensify, and it is not impossible to foresee UK content dipping on projects at these levels of awards. Can we have both above 50% UK content and ‘zero subsidy’ projects? Time will tell.

What new opportunities open up after this outcome?

The prevalence of two developers in four projects gives them the opportunity to reduce their equity positions or even sell. This means there are opportunities for developers who have yet to get a foothold in the UK and may be a bit wary of the development risks in The Crown Estate’s Round 4 and Crown Estate Scotland’s ScotWind. We have seen this engaging with developers, some are keen to entering those auctions but need a partner to share development risk.

Furthermore, the integration of those 5GW Dogger Bank projects in Yorkshire and the Humber region by 2025 will also be a challenge. The scale of SSE and Equinor projects in Dogger Bank, which will be the first to use HVDC in the UK, will open up possibilities energy storage systems to firm the power output of the wind farm. Plus, there could be opportunities for energy storage/flexibility project developers onshore to help manage and optimise transmission and distribution networks in terms of system balancing and ancillary services, due to this large variable power fed into the region.

But this is not the end until the next CfD auction in 2021…

How will CfD4 look like?

It will be crucial to see how the results of CfD3 will affect the terms of the next CfD auction to be held in 2021 with regards to capacity cap, budget cap and administrative strike prices (the maximum bids developers can place). Would BEIS dare to remove capacity caps in the next auction since the budget impact of the projects awarded is zero? We will never know the bids from all developers, but if all were below £48.62/MWh – 2023/24 reference price [2], which was the lowest reference price among the years considered – and there had not been a capacity cap, all would have qualified with zero budget impact. Furthermore, will they foster hybrid projects to ease the integration of renewables (via the integration with interconnectors, hydrogen or energy storage systems) and how?

Otherwise, on 25 September EDF released an update on Hinkley Point C stating that the estimation of project costs have increased between £1.9bn to £2.9bn compared to their previous estimate (roughly a 10% cost increase) and the risk of delay in commercial operations date has increased too [2]. Therefore, could these issues lead the UK Government and BEIS to bring forward CfD4 and lift capacity caps?

TCE Round 4 and ScotWind implications?

It is interesting to see how this will affect developers interested in the ongoing seabed lease auctions by The Crown Estate (TCE) and Crown Estate Scotland (CES); the projects awarded in those processes will be commissioned by 2030 and they will need to thoroughly assess the technical feasibility of those in such a competitive scenario. While TCE’s process deliberately chose to focus on fixed sites only, CES will likely release some sites only accessible for floating foundations. Even if those sites had better wind regimes it will be tough to compete against fixed at these prices, due to higher floating CAPEX costs, but also due to higher grid charges in Scotland. Note that Equinor targets a LCOE for their Hywind technology of €40 to €60/MWh by 2030 [3]; so this round has reinforced the view that a separate pot would be necessary for floating wind.

This leads to fundamental question on routes to market for offshore wind after CfD3.

Will developers look for alternative routes to market after the results of CfD3?

Since winning bids are below market prices, will there be any developers keen to exploring alternative routes to market, i.e. accepting merchant risk partially hedged with corporate power purchase agreements (PPAs), and not wait until the next CfD round in 2021? Price cannibalisation risks with high renewables build out post 2030, swings in commodity prices and the revenue certainty provided by a CfD contract cannot be underestimated. Nevertheless, the next auction could even be more oversubscribed with Orsted´s Hornsea 3 (2.4GW), Vattenfall’s Norfolk Boreas and Vanguard in East Anglia (totalling 3.6GW), potentially more projects by Scottish Power in East Anglia and SSE in the Firth of Forth, the wind farm extensions (2.8GW) if they get consent before the next auction opens in 2021, and the projects which didn’t succeed last Friday.

Therefore, some projects could decide to go merchant with a CfD for a part of a project and build the rest with merchant exposure or directly build the full project as a merchant asset partially hedging their power with corporate PPAs, electricity supply contracts with industrial or corporate counterparties. Nobody has done that in the UK yet, because there are lots of uncertainties in the UK, and European, power markets: from nuclear new build (which will face more cost pressures after offshore wind landed these cost reductions); to levels of interconnection with other European markets; electrification of heating and transportation; take off of storage, demand side response and electric vehicles to balance the system; advances in weekly and seasonal storage (power to gas or power to hydrogen); prospects of merchant solar pv and onshore wind; and price cannibalisation levels eroding merchant revenues. Power price forecasts depend on all those factors, so they are very dynamic. That’s why taking a bet on market prices for the next 15 years is really challenging and this risk is priced in more expensive project finance.

Still the Netherlands, with Vattenfall’s Hollandse Kust Zuid 1&2 and Hollandse Kust Zuid 3&4, and Germany, with EnBW’s He Dreiht and four projects by Orsted, have shown zero subsidy bids; although developers do not pay for transmission costs there. In those markets developers try to establish corporate PPAs to hedge power prices. However, most of the time those are short duration contracts, the longer the contract the higher the discount, against a 15-year CfD with the treasury as counterparty (no default risk).

This shift in business model mainly benefits developers with a large presence in retail markets (i.e. electricity utilities), but it also introduces lots of new risks. There are no vanilla PPAs out there, every contract will likely be renegotiated, and offshore wind projects would also need the aggregation of many offtakers due to large project sizes.

Another point to consider is, will HMG allow such unregulated development off her coastline? This is an interesting area and will likely see some mechanism to allow this as the market pressure may demand it. Once there are no subsidies and developers are not given anything it is hard to ask for any local content or guarantees in return.

To sum up, these bids have been a real game changer

Last week’s results have been a real game changer for the offshore wind industry, a landmark moment in the fight against this climate emergency. Now these projects need to be delivered on time and on budget and help creating a healthy and sustainable supply chain for the new projects to come.

References

[1] A. Lee, “Drastic Change as Zero-subsidy Stokes Offshore Wind Tension: Contractors,” Recharge News, [Online]. Available: https://www.rechargenews.com/wind/1840801/drastic-change-as-zero-subsidy-stokes-offshore-wind-tension-contractor.

[2] The budget impact of the projects is calculated considering the difference between reference prices and bid prices.

[3] EDF France, “Update on Hinkley Point C Project,” 25 09 2019. [Online]. Available: https://www.edf.fr/en/the-edf-group/dedicated-sections/journalists/all-press-releases/update-on-hinkley-point-c-project.

[4] Equinor, “Our Ambitions on Hywind,” [Online]. Available: https://www.equinor.com/en/what-we-do/hywind-where-the-wind-takes-us/our-ambitions-for-hywind.html.